This website uses cookies

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

The clinic provides both classroom and hands-on experience addressing public investor disputes with securities broker-dealers. Classroom time focuses on the substantive conduct and arbitration rules of the Financial Industry Regulatory Authority (FINRA). The range of projects at any given time varies with real-world events, but can include “live-client” case evaluation and prosecution through FINRA, regulatory comment letters, public presentations on preventing investment fraud, mock mediation and arbitration events, amicus briefs, and research projects. The SLC offers up to a three-semester sequence, though students can take only the intro semester if desired.

Coursework includes training in skills such as interviewing potential clients, evaluating potential claims, preparing pleadings, conducting discovery, representing clients at hearings, and negotiating settlements. The SLC conducts in-house mock mediations and mock arbitrations using actual case documents so that students get a real-world advocacy experience.

Substantive topics covered include:

Students have the opportunity to research and write on legal topics of importance to investors, including regulatory comment letters, amicus briefs, and research articles. Numerous SLC students have had their research papers published in law and Bar journals. The SLC also provides input and editing for the securities arbitration sections of the Cornell Legal Information Institute.

Securities Law Clinic students (from left) Jade Lee, Jianing Zhao, Zachary Hunt, and Nicholas Hietpas traveled to Washington, DC, in March 2024 to attend the U.S. Securities and Exchange Commission 2024 Investor Advocacy Clinic Summit. The event gave students and Professor Robert Banks (seated in front) an opportunity to engage with SEC staff and invited guests on topics related to providing free legal services to underrepresented investor groups. Cornell Law students provided comment letters to the SEC on proposed regulations and shared their experience educating the community on investment fraud.

Under the guidance of Professor William Jacobson and Professor Robert Banks, four students in Cornell Law School’s Securities Law Clinic traveled to Upstate Oasis, a senior education center in Syracuse, to give a public presentation on investment fraud schemes that target seniors and retirees. Giana Wang ’25, Lin Zhuang ’25, Lucy Liu ’25, and Kaitlyn Greening ’24 spent an afternoon in March 2024 speaking to a group of attendees about the obligations of financial professionals, red flag warnings for dangerous investments, dangerous investment products, and how to background check investment professionals.

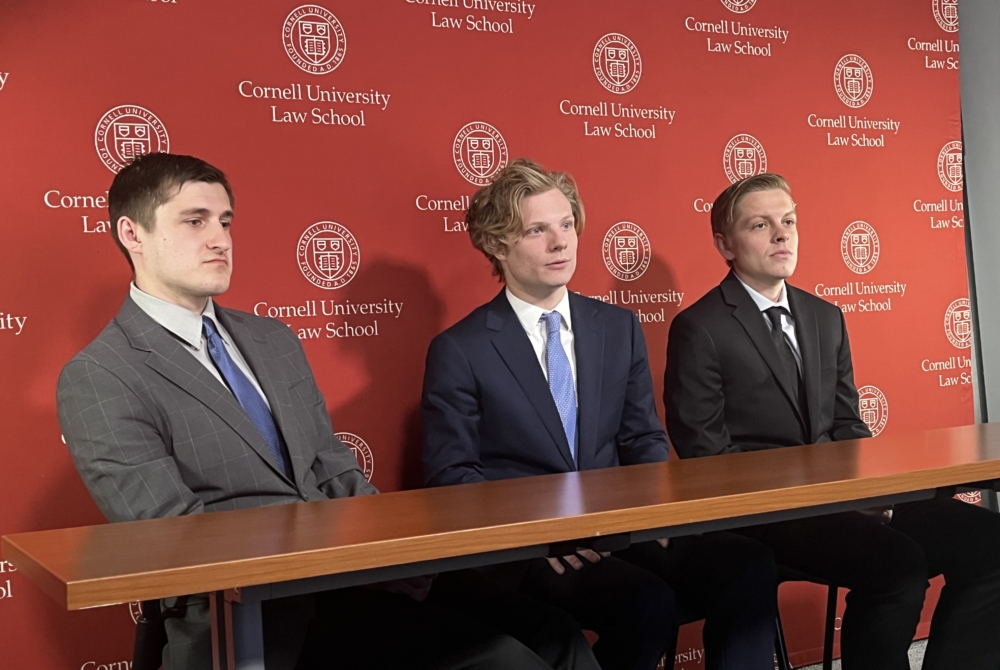

Clinic students Dustin Hartuv, Nicholas Hietpas, and Erik Olson presented at the SEC’s 2023 Investor Advocacy Clinic Summit.

Adjunct Professor Robert Banks (left) and Zach Hunt ’23 during a spring 2023 presentation to the SEC.

Clinic students delivered a presentation on avoiding investment fraud at the Oasis and Earthlink Learning Center in Syracuse, NY, in March 2023.

Students participated in a mock mediation led by guest Jeffrey Grubman (seated at left), a mediator from Florida.

The SLC fills a need in the largely rural Southern Tier region of upstate New York, where the public does not generally have access to an extensive private bar with experience in investor rights. A focus of the clinic is representation of public investors in disputes subject to arbitration at the Financial Industry Regulatory Authority (FINRA), though the availability of cases varies from semester to semester.

As part of its community outreach, the SLC also provides public education on investment fraud, with particular attention to investment schemes targeting the elderly and retirees. Substantive legal topics covered in the clinic include the scope and nature of binding arbitration under the Federal Arbitration Act and New York law, and the legal and regulatory remedies available to defrauded investors.

Securities Law Clinic I is the introductory course.

Securities Law Clinic II is an optional second-semester course for students who have completed Securities Law Clinic I and want to further hone their advocacy and investor representation skills.

Securities Law Clinic III is an optional third semester, generally reserved for students who want to continue working on cases and projects that carry over from SLC II.